🚗 How to Pay Your Vehicle Token Tax in Islamabad: Your Complete Guide

Alright, Islamabad vehicle owners, it’s that time of year again-token tax! We all understand that it is an essential part of keeping our vehicles on the road legally. The good news is that paying your token tax in Islamabad has become easier than ever, with both online and offline methods available.

This guide will walk you through each procedure step by step, ensuring that you do this chore with ease. Let’s dive in!

📱 Option 1: Pay Online with the City Islamabad App (Highly Recommended!)

The official City Islamabad App is the most convenient way for most residents, especially those with smart card registrations, to pay their token tax. This mobile app, developed by the National IT Board in collaboration with the ICT Administration, delivers a number of services directly to your smartphone, including token tax payment.

Here’s your step-by-step guide to paying via the app:

📥Step 1: Download the City Islamabad App

If you don’t already have it, search for “City Islamabad App” in your mobile app store and download it.

- For Android users: Download it from the Google Play Store. [https://play.google.com/store/apps/details?id=com.gov.pk.ictadministration].

Search “City Islamabad App” in the search bar to get the app. - For iPhone users: Download from the Apple App Store. [https://apps.apple.com/pk/app/city-islamabad/id1503124488 ].

Search “City Islamabad” in the search bar to get the app.

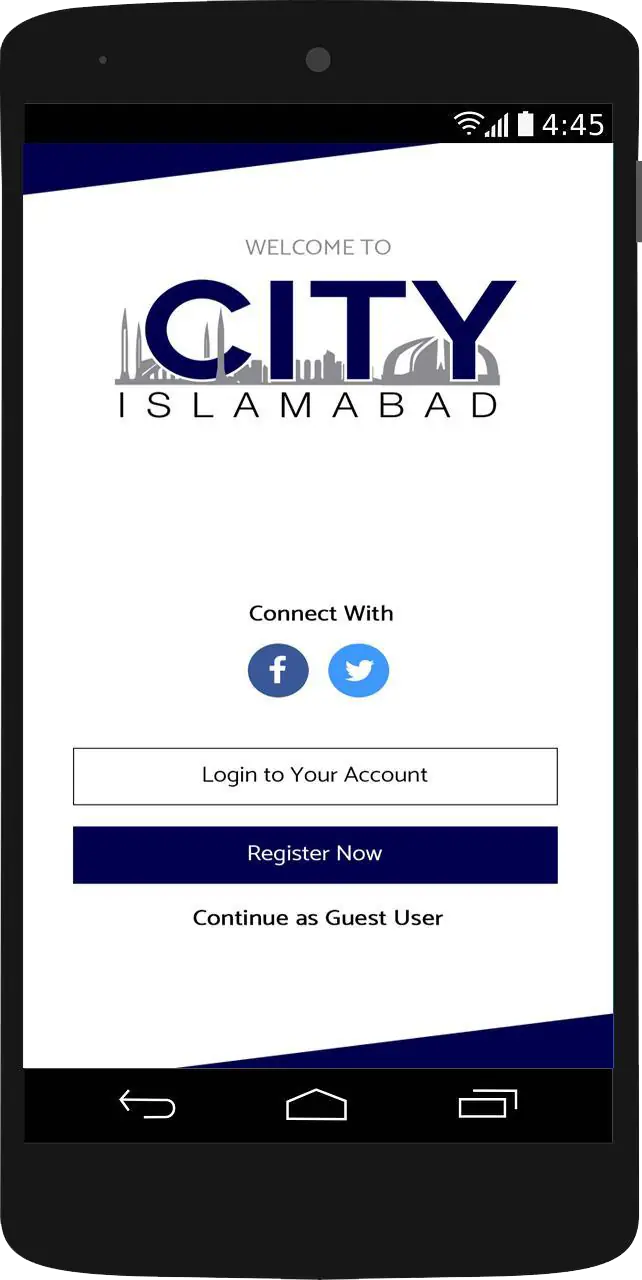

🔐Step 2: Register or Log In

Open the app. If you’re a first-time user, you need to register by providing your CNIC and other vital details. If you’ve previously used the app, simply log in using your existing credentials.

🏛️ Step 3: Navigate to Excise & Taxation

Once you are in the app, look for the section dedicated to government departments. Find and tap on the “Excise and Taxation” option. Vehicle-related services are available here.

🧾Step 4: Select “Token Tax”

Within the Excise & Taxation menu, you will notice many available services. Select “Token Tax” by tapping on it.

💳 Step 5: Choose “Pay Token Tax”

There will be option to view your token tax history or pay current dues. Select “Pay Token Tax” to proceed with a new payment.

🔢 Step 6: Enter Your Vehicle Registration Number

Carefully enter your vehicle’s complete registration. Like XYZ-123

📄 Step 7: View Due Taxes and Generate Payment ID

The app will display your vehicle details along with the token tax amount currently due for 2025 (or with previous year(s) if still outstanding).

After verifying the details, the app will guide you to generate a unique payment identifier. This can either a 1BILL PSID (Payment System ID) or an e-sahulat tracking ID. Note down this ID carefully or keep the phone screen open.

💸 Step 8: Complete the Payment Using Your Generated ID

Use the generated PSID – if 1BILL option is selected or the tracking ID – if e-sahulat to make the payment through your preferred digital channel:

- 🏦 Online Banking: Log in to your bank’s internet banking portal or mobile app. Look for “Bill Payment”, “Tax Payment,” or “1BILL” option. Select “Excise and Taxation” as the biller and enter the PSID. The due amount will be fetched by app. After confirmation of the amount, click Pay.

- 📲 Mobile Wallets (EasyPaisa, JazzCash, etc.): Many mobile wallet apps support 1BILL payments. Find the “Bill Payment”, “Government Payments” or “1BILL” option and enter the PSID. The due amount will be fetched by app. After confirmation of the amount, click Pay.

- 🏧 ATM: Visit any ATM of a bank that is part of the 1Link network. Select “Tax Payment,” then “Excise and Taxation,” and enter your PSID.

- 🧾e-sahulat Franchise (for Tracking ID): If you generated an e-sahulat tracking ID, visit your nearest e-sahulat center and provide the ID to pay in cash.

After the successful payment you should receive a confirmation message. It’s recommended to take a screenshot or save the digital receipt. The payment status in the City Islamabad App may take some time to update.

🧍 Option 2: Pay In-Person at the Excise and Taxation Department

If you prefer the traditional method or are having trouble using the app, you can still pay your token tax at the Excise and Taxation Department office.

📃 Step 1: Prepare Your Documents

You will need your vehicle’s original registration book or smartcard. Having a copy of your CNIC is also recommended.

📍 Step 2: Visit the Excise and Taxation Department

Head to the Excise and Taxation Department office located in Sector H-9, Islamabad. [Click here to see on the Google Map]. You can also find the contact information and location details on the official ICT Administration Excise and Taxation Department website [https://ictadministration.gov.pk/excise-taxation/].

🪪 Step 3: Proceed to the Relevant Counter

When you arrive, inquire about the counter where you may pay token taxes. Be prepared for potentially long queues, particularly closer to the deadline.

📝 Step 4: Provide Vehicle Information and Documents

Provide your vehicle registration documents and provide the essential information to the officer at the counter.

💰 Step 5: Pay the Due Amount

The official will inform you of the token tax amount due. Pay the amount in cash or through any other accepted method at the counter.

The officer will inform you of the exact token tax amount. Pay the amount required in cash or using another acceptable method.

🧾 Step 6: Collect Your Receipt

Most importantly, make sure you receive an authentic, stamped payment receipt as soon as you pay. This is your tangible evidence of payment, which should be maintained with the vehicle’s documentation.

📌 Essential Reminders for Islamabad Token Tax:

- ⏰ Know the Deadline: Always be aware of the token tax payment deadline. Late payments draw in fines and in serious condition may result in complications like vehicle impoundment and even registration cancellation. Check for official notifications from the ICT Excise and Taxation Department.

- 📊 Verify the Amount: Use the City Islamabad App or inquire at the office to confirm the exact token tax amount due for the particular vehicle. The tax amount depends on factors such as engine capacity and vehicle age.

- 🗂️ Keep Proof of Payment: Whether digital or printed, your payment receipt is essential. Keep it safe alongside your vehicle documents.

- 🔄 Check Payment Status: If you paid online, check the City Islamabad App or contact the department to ensure that your payment was properly completed and shown in their records.

Paying your vehicle token tax in Islamabad for 2025 is a necessary task, but thanks to the digital options available like the City Islamabad App, it’s becoming much more manageable. Choose the method that works best for you and ensure you pay on time to avoid any inconvenience!

Paying the vehicle token tax in Islamabad is an essential duty, but with digital solutions like the City Islamabad App, it’s getting a lot easier. Choose the way that works best for you, and make sure to pay on time to avoid any hassle!